Forex Trading

with TradingExcel

TradingExcel: Forex trading for the experts

Advantages of forex trading with TradingExcel

One platform with multiple instruments and markets

With us as your broker, you can use one platform for forex trading as well as for indices, commodity CFDs and cryptocurrency CFDs.

You're trading with a true ECN broker

trusted by more than 1 million traders worldwide.

Highly

customisable

to your individual trading style and strategies, meaning you are in complete control of your trading.

Access to automated trading

You have the choice to download and use ready-made scripts and expert advisors or create a custom indicator or script, based on your very own trading strategy.

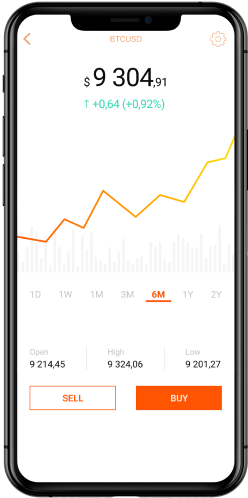

Access anytime, anywhere

via the desktop, web-based or mobile version of the MT4 trading platform.

Access to a wide range of analysis

50+ built-in indicators and graphic tools for technical analysis, quotes history center, strategy tester and news, all designed to help you increase your trading knowledge.

Setting measurable goals in a volatile market

Whether you’ve been trading for a year or have decades of experience behind you, it’s vital to set yourself quantifiable goals before you begin. That could be achieving a 20% annual return on your investment or getting a total of 100 pips a month – whatever your goal, it should be easily measured.

How does forex trading work?

The risks and rewards of the forex market

Another of the key risks to consider is that some forex pairs are much more volatile than others, and pairs that include USD are often in high demand making them more liquid than others.

If you’re aware of the risks and take steps to mitigate them, the forex market can be very rewarding. However, to gain the rewards and profits you may be looking for, you need to have a full understanding of all risks involved in trading and the forex market.

Expert trading for expert traders at TradingExcel

TradingExcel is one of the best forex trading platforms, with a range of major, minor and emerging currency pairs for you to go long or short on, as well as forex charts and other useful tools like an economic calendar. Why not get in touch with our team today to access a live account. Offering you the ability to trade in over 50 forex markets, 24 hours a day from Sunday night until Friday night, discover for yourself why so many experts trade with TradingExcel.

Why do people trade forex?

People trade on the forex market for a number of different reasons. The foreign exchange markets are the largest and most liquid financial markets in the world, making them immensely popular among forex brokers and traders. Forex trading exploded in popularity because of its leverage, continual trading opportunities, high liquidity and low entry costs.

What is a forex broker?

After the 1970s, when the United States

dropped the

Bretton

Woods agreement

regarding the USD convertibility in gold,

the foreign exchange market grew

dramatically. First available only to

institutional players due to the high

transaction costs and difficulty to access,

it all changed when the internet and online

trading appeared. Forex brokers made it

possible for the retail trader to join the

largest financial market in the world.

A

forex

broker

is an intermediary link between the trader

and the market. It offers market quotes via

its various liquidity providers, and its

trading platform reflects the best possible

conditions it has to offer to its customers.

For this, it charges a fee or a commission,

and its interests align with those of the

trader.

Brokers are organised as either a dealing

desk (also called market makers) or a

non-dealing desk. A dealing desk creates a

market by mirroring the quotation from the

interbank market and deals the prices to its

clients. In non-dealing desks, forex brokers

route their clients’ orders to the liquidity

provider, and the best quote is offered to

retail clients from the liquidity pool.

Brokers organised like non-dealing houses

often offer ECN (Electronic Communication

Network) or STP (Straight-Through Protocol)

execution. However, different types of forex

brokers exist, mixing dealing with

non-dealing conditions, and operating as

hybrid entities.

Depending on the type of the brokerage

house, different account types exist. ECN

accounts and STP accounts are just a couple

of examples.

What factors move the forex market?

Because the forex market is made up of

currencies from across the globe, predicting

exchange rates is difficult as there are a

number of factors that constantly move

prices. The main driving factors for these

moves are central banks, news reports and

market sentiments. Understanding how each of

these operate will help you on your trading

journey.

It’s also important to remember that prices

move up and down based on supply and demand,

just like any other financial market. As a

forex trader, you’re likely to either choose

to put your money into an economy that has

strong growth potential or short a market.

How to define success as a forex trader?

No matter if you’ve been trading for a short

or long time, defining your success will

help you to become an expert trader. Think

about what you want to achieve from it and

how you personally define success.

Setting goals is vital and these should be

easy to measure. It’s also recommended you

set a target that can be achieved over a

long timeframe, annually for example, as

opposed to monthly. Once you’ve established

these factors, you’ll be able to put your

action plan into work.

Regardless of how experienced you are, it’s

important to always manage your expectations

throughout the forex trading process, and

control your emotions. To become a

successful trader, you must understand the

mechanics of the forex market, trust your

analysis and follow the rules of your forex

trading strategies.

with TradingExcel